Home to companies like GM, Steel Dynamics and Vera Bradley, Northeast Indiana’s quality of life attracts a skilled workforce.

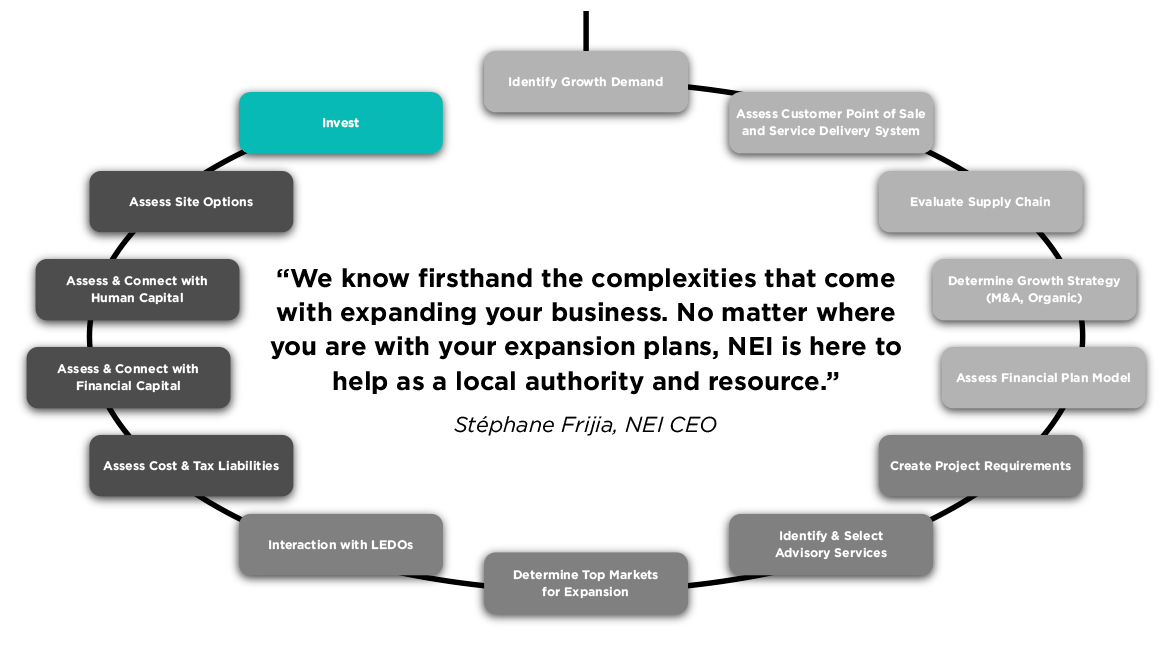

Our business development team provides confidential, expert support to companies as they plan their expansion and relocation strategies. We are uniquely set up to gather the required data and information and convene key stakeholder and decision makers to streamline the initial due diligence process.

We provide introductions to colleges, universities, workforce assets, state and local regulatory authorities, job training programs, startup resources, business leaders, etc.

We aggregate a comprehensive listing of value-based assets, unique buildings and shovel-ready sites, as well as prepare GIS mapping analysis.

Our research team performs annual operating cost comparisons across major markets. We also analyze transportation, real estate, tax incentives and labor costs, as well as evaluating a project's economic impact and community benefit.

We provide current wage rates, labor force and skill levels based on occupation and industry, analyze labor force availability data, and connect you with local employers for additional insights.

We coordinate with our partner organizations to host press conferences and distribute news releases in effort to publicize new location announcements.

“Northeast Indiana has undergone a major transformation in the last decade. As the 11-county region continues this momentum, it’s a rewarding time to operate a business in this thriving area. The business-friendly climate and skilled workforce are why we do business in Northeast Indiana,” said Mark Millett, chairman, president and CEO of Steel Dynamics.

We’re With You Every Step of the Way!

Are you ready to join the momentum?